Over the past months, the Chinese economy has shown signs of strain, casting shadows on the optimism that has been a hallmark of its growth story. Several factors have contributed to this unsettling scenario, including a deceleration in manufacturing output, a slowdown in export growth, and a looming property market crisis. These issues, combined with a backdrop of tighter regulations on various industries, have contributed to an atmosphere of uncertainty among investors and businesses alike.

The Chinese stock market, a barometer of the nation’s economic health, has borne the brunt of these concerns. Investors, once enticed by China’s growth potential, are now exhibiting caution, leading to a noticeable decrease in demand for stocks. This reduced appetite for equities has caused a slump in stock prices across various sectors.

Technology companies, which were once the darlings of the Chinese stock market, are also grappling with the fallout. Regulatory measures aimed at curbing monopolistic practices and increasing data security have led to a reevaluation of these companies’ growth prospects. As a result, the technology sector, once a symbol of China’s innovation prowess, is now facing a downturn.

The ripple effects of China’s economic uncertainties are felt far beyond its borders. China’s role as a manufacturing hub and a major player in global trade means that any shifts in its economic trajectory can have far-reaching consequences. International investors and businesses are closely watching this situation, as it can influence global supply chains and trade dynamics.

Furthermore, China’s financial markets are intertwined with those of other economies, making the global financial system susceptible to shocks emanating from the country. The interconnectedness of modern financial markets means that a significant slump in Chinese stocks could trigger a chain reaction affecting markets worldwide.

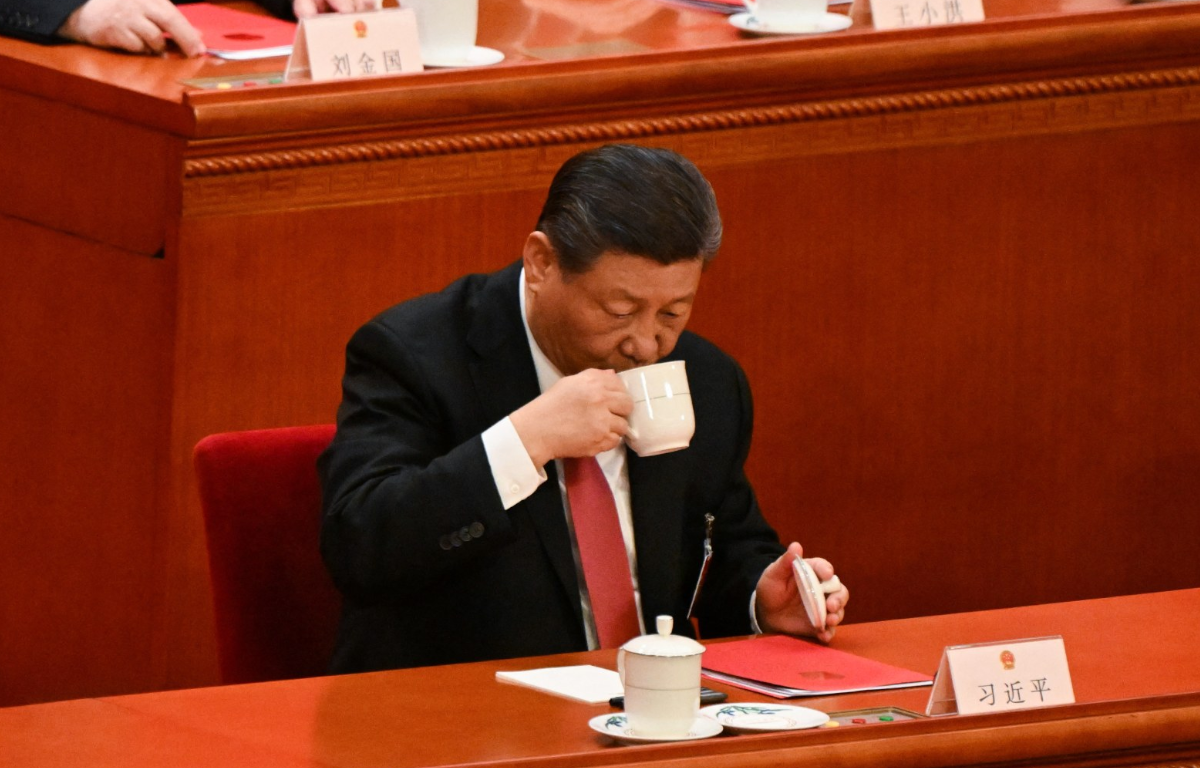

In response to these challenges, the Chinese government has taken steps to stabilize the economy and restore investor confidence. Policymakers have announced measures to support sectors under pressure, and there have been efforts to streamline regulations to balance economic growth with stability. These steps reflect China’s commitment to finding a delicate equilibrium between fostering innovation and ensuring a resilient financial system.

The future outlook remains uncertain, as the outcome hinges on a multitude of variables. China’s ability to navigate through these challenges will depend on its adaptability, resilience, and capacity to address structural issues within its economy. International collaboration and a nuanced understanding of global economic interdependencies will also be critical in shaping the road ahead.

Share this: