Foreign investors are offloading significant amounts of Chinese assets as regulatory uncertainties continue to escalate. China’s government has implemented policies to tighten control over industries like technology, finance, and education. Sudden regulatory changes and crackdowns have left investors unsure about the stability and predictability of the business environment, eroding confidence in Chinese assets.

Geopolitical tensions between China and major economies contribute to the exodus of foreign investors. Trade disputes, territorial conflicts, and human rights concerns create an environment of instability and uncertainty. These geopolitical risks have made investors increasingly cautious, leading them to reassess their exposure to Chinese assets.

China’s economic growth, once unstoppable, has shown signs of slowdown. Structural challenges, rising debt levels, and demographic shifts cast doubts on the sustainability of China’s economic expansion. Foreign investors, aiming for stable returns, worry about the impact of a slower-growing Chinese economy on their portfolios.

Limited transparency and disclosure standards in China’s markets have long worried foreign investors. Inadequate access to reliable information, opaque corporate governance practices, and difficulties in enforcing legal rights hinder investors’ ability to make informed decisions. The lack of transparency exacerbates the perceived risks associated with investing in Chinese assets.

Foreign exchange risks and capital controls imposed by the Chinese government further complicate investing in China. Fluctuations in the value of the Chinese yuan can significantly impact returns on investments denominated in yuan. Additionally, uncertainty surrounding the ability to freely repatriate funds raises concerns for investors seeking liquidity and flexibility.

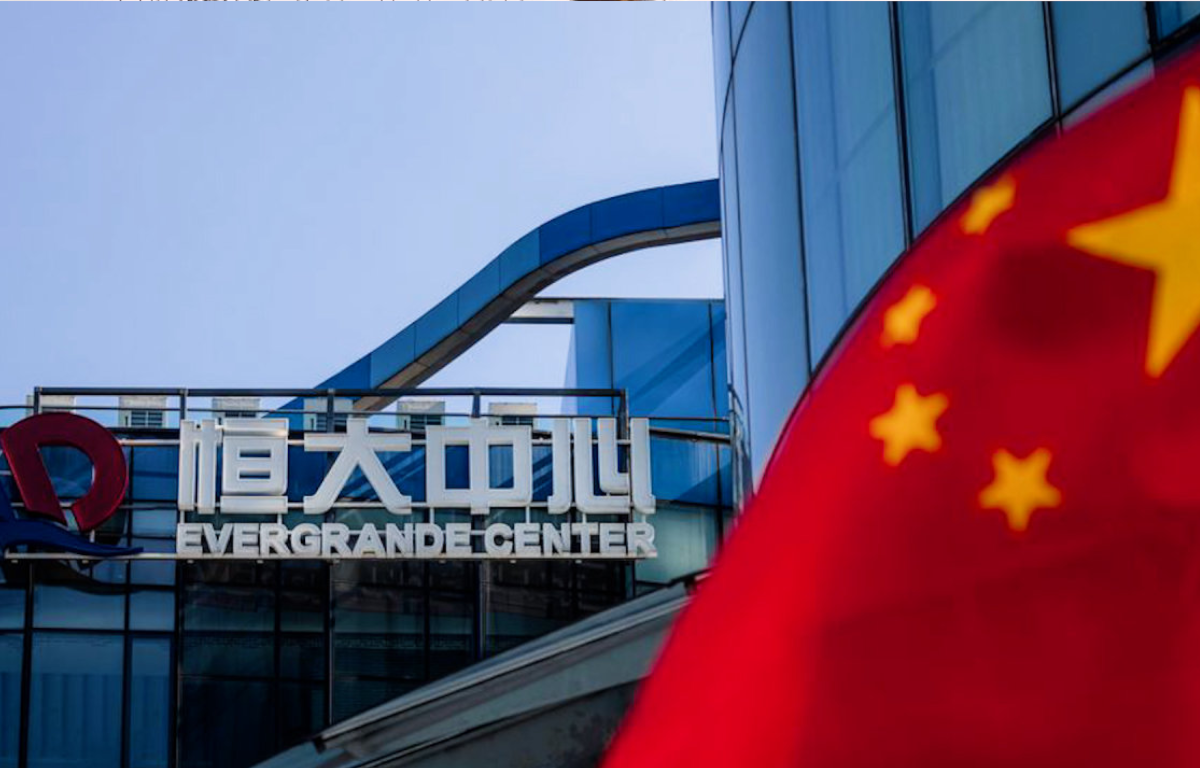

The significant divestment of Chinese assets by foreign investors highlights the mounting risks in China’s markets. Regulatory uncertainties, geopolitical tensions, economic slowdown, lack of transparency, and currency risks all contribute to this trend. As foreign investors reassess their investment strategies, it is crucial for China and investors to address these concerns and work toward creating a more stable and predictable investment environment.

Share this: