Intel’s pursuit of Tower Semiconductor, an Israeli analog semiconductor foundry specialist, was hailed as a strategic move aimed at fortifying Intel’s position in the global semiconductor market. Tower Semiconductor’s expertise in analog chip manufacturing holds paramount importance across a spectrum of applications, encompassing automotive, industrial, and consumer electronics. The acquisition was anticipated to enhance Intel’s capabilities in crafting tailor-made chips for diverse clientele, thus expanding its revenue streams beyond its traditional CPU-centric focus.

The deal had successfully navigated regulatory approvals from various nations, including the United States, the European Union, and Israel, signifying significant progress toward its finalization. Intel’s commitment to invest in and bolster Tower Semiconductor’s manufacturing capacity in Israel was viewed favorably, as it promised to stimulate job creation and augment the local economy.

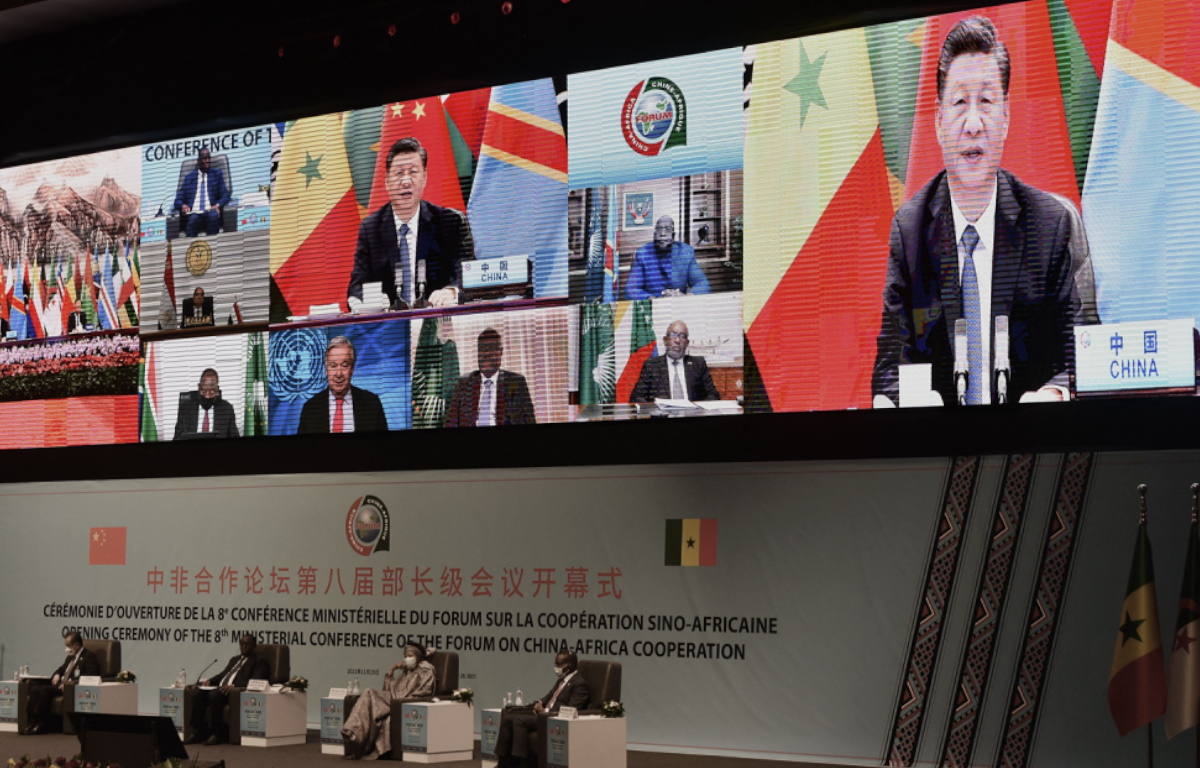

China has emerged as a pivotal player in the global semiconductor arena. The nation has made substantial investments in domestic semiconductor production, a vital component of its “Made in China 2025” initiative aimed at reducing reliance on foreign chip providers. Consequently, China vigilantly monitors significant semiconductor deals, including Intel’s acquisition of Tower Semiconductor.

China’s primary apprehension revolves around the potential ramifications of this acquisition on its burgeoning semiconductor sector. The concern is that Intel, equipped with abundant resources and technological prowess, could secure a competitive edge, posing a threat to Chinese semiconductor enterprises. China has previously exercised its regulatory authority to obstruct or revise international agreements deemed adverse to its interests.

Moreover, amid escalating geopolitical tensions between the United States and China, China may view this acquisition with heightened skepticism. The U.S. government has imposed stricter export controls on certain semiconductor technologies, further straining bilateral relations. China’s response to the Intel-Tower Semiconductor deal might be influenced by these overarching geopolitical dynamics.

Implications for the Semiconductor Industry

The potential obstruction of Intel’s acquisition of Tower Semiconductor by China could have profound implications for the semiconductor sector.

- Market Dynamics: If the deal is blocked or significantly altered, it could disrupt Intel’s plans to diversify its semiconductor portfolio and venture into new markets. Tower Semiconductor’s growth prospects, which had been contingent on Intel’s resources, could also be jeopardized.

- Geopolitical Tensions: A Chinese blockage could further exacerbate the ongoing technology and trade disputes between the United States and China. This may lead to retaliatory measures, including stricter export controls and trade restrictions on semiconductor-related technologies.

- Opportunities for Other Players: Should the Intel-Tower Semiconductor deal falter, it could create opportunities for other semiconductor companies to step in and potentially forge alternative partnerships or acquisitions. This could reshape the industry’s competitive landscape.

- Supply Chain Implications: The semiconductor industry already grapples with supply chain disruptions. Regulatory uncertainties and delays stemming from this situation could exacerbate these challenges, potentially affecting numerous industries reliant on semiconductor components.

The Intel-Tower Semiconductor deal, originally slated for closure today, faces an uncertain future as China’s potential involvement looms large. The semiconductor sector, already marked by intense competition and supply chain disruptions, closely monitors this unfolding situation. The outcome will not only impact the two corporations involved but could also reverberate across the global semiconductor landscape and influence international relations within the tech sector. This pivotal moment underscores the intricate convergence of technology, geopolitics, and economics in today’s interconnected world.

Share this: