Evergrande, founded in 1996 by entrepreneur Xu Jiayin, grew rapidly over the past two decades. The company expanded aggressively, acquiring land and developing residential projects across China. It became known for its ambitious projects, from luxury apartments to massive sports complexes.

At its peak, Evergrande was the world’s most valuable real estate company. It was a symbol of China’s property-driven economic boom, with revenues surpassing $60 billion in 2020. However, its rapid expansion was heavily reliant on debt, both in the form of bank loans and pre-sales from homebuyers.

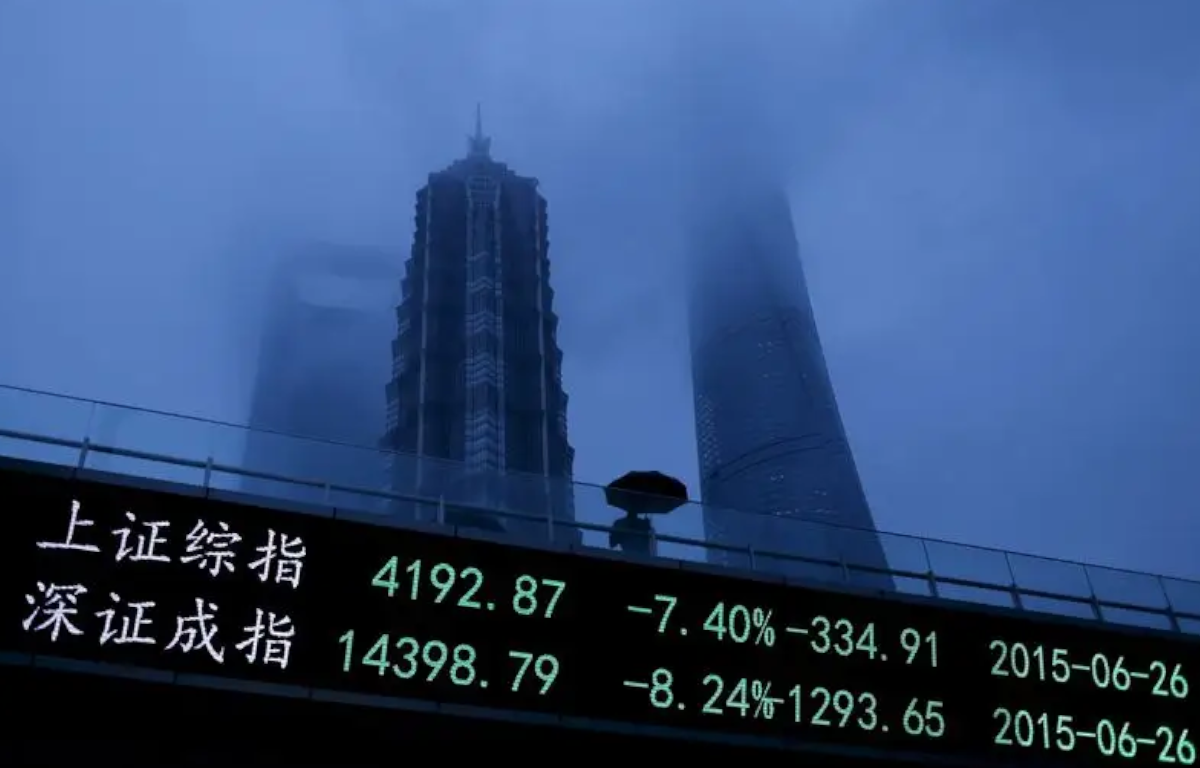

Evergrande’s debt problems began attracting international attention in mid-2021 when it failed to make payments to suppliers, contractors, and investors. The company was also grappling with government policies aimed at curbing excessive borrowing by property developers, making it more challenging for Evergrande to raise funds.

The company’s financial troubles became increasingly dire, with its total liabilities reaching over $300 billion, making it one of the world’s most indebted companies. Concerns grew that Evergrande might default on its debt obligations, which would have far-reaching consequences for China’s property market and beyond.

The crisis surrounding Evergrande has sent shockwaves through the Chinese property market. Homebuyers who had invested their savings in Evergrande properties faced uncertainty about the completion of their homes. This has led to protests and clashes with authorities in various Chinese cities.

Furthermore, the broader real estate market has been affected, as other property developers face higher borrowing costs and reduced access to financing. This, in turn, has raised concerns about the potential ripple effects on China’s economy, which has relied heavily on the property sector for growth.

The Evergrande crisis also has global implications. International investors hold Evergrande’s bonds, and the potential default has raised concerns about the exposure of global financial institutions to the Chinese property market. Stock markets worldwide have reacted nervously to developments, as investors fear a contagion effect similar to the global financial crisis of 2008.

In response to the crisis, the Chinese government has taken steps to prevent a disorderly collapse of Evergrande. Regulators have urged local authorities to ensure the delivery of completed homes to buyers and the protection of their rights. Additionally, Evergrande has been ordered to resolve its debt problems and prioritize unfinished housing projects.

However, the government’s approach is a delicate balancing act. While it aims to prevent a systemic crisis, it also seeks to curb excessive debt and speculative activity in the property market.

The Evergrande crisis is a stark reminder of the challenges faced by China’s property market and its broader implications for the global economy. It underscores the risks associated with rapid and debt-fueled expansion in the real estate sector. As the situation continues to evolve, the world will closely watch how Chinese authorities navigate this complex issue and what lessons can be learned for the future of the property market in China and beyond.

Share this: