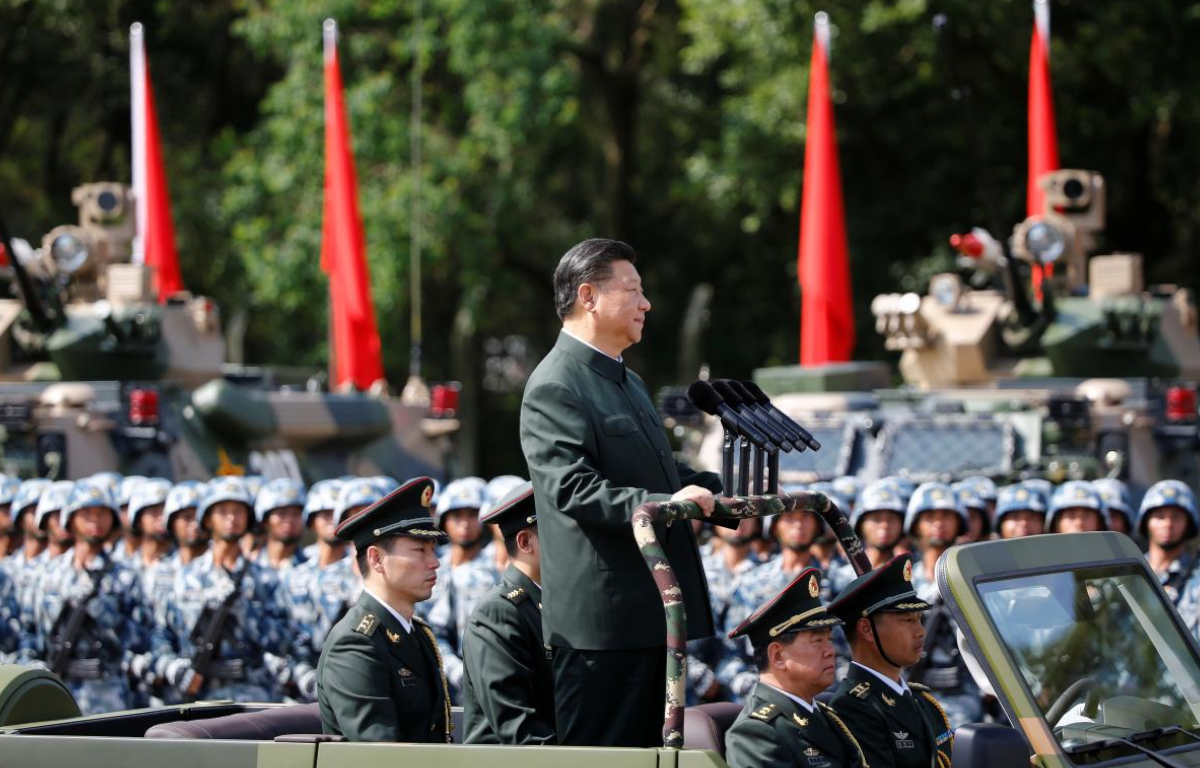

China’s rapid economic growth over the past few decades has been nothing short of remarkable. Under the leadership of President Xi Jinping, the country has continued to modernize and expand its influence on the global stage. However, as the saying goes, “all that glitters is not gold.” While China’s economic rise has been impressive, it has also been accompanied by a set of challenges that could potentially threaten the stability of the nation’s economy. This article explores how President Xi’s policies may have shortened the fuse on what some experts consider to be a ticking economic time bomb in China.

One of the primary concerns regarding China’s economy is its soaring debt levels. Over the years, China has relied heavily on debt to fuel its economic growth. While debt can be a useful tool for development, it becomes problematic when it reaches unsustainable levels. China’s total debt, including government, corporate, and household debt, has grown to alarming levels, surpassing 300% of its GDP. This has raised concerns about the ability to service and repay these debts, potentially leading to a financial crisis.

President Xi’s policies have not done much to alleviate this issue. In fact, his emphasis on maintaining high economic growth rates has often translated into policies that encourage borrowing and investment, exacerbating the debt problem. Additionally, the state’s role in the economy has increased under Xi’s leadership, with state-owned enterprises (SOEs) receiving significant support. This has led to inefficient resource allocation and a misallocation of capital, further contributing to the debt burden.

Another concerning aspect of President Xi’s policies is his government’s crackdown on the private sector. While the state’s involvement in the economy has expanded, private businesses have faced increased scrutiny and regulation. This has created an environment of uncertainty and fear among entrepreneurs and investors.

The private sector has been a vital engine of China’s economic growth, contributing significantly to job creation and innovation. However, the recent crackdown on tech giants, such as Alibaba and Tencent, as well as various regulatory changes affecting a wide range of industries, has sent shockwaves through the business community. This has the potential to stifle innovation and economic dynamism, hindering China’s ability to adapt to changing global economic conditions.

China is also grappling with significant demographic challenges. The country’s population is aging rapidly, and the birth rate is declining. This demographic shift will strain the country’s pension and healthcare systems while reducing the size of the labor force. As a result, China may face labor shortages and increasing welfare costs, which could hamper economic growth.

While President Xi’s government has attempted to address this issue by relaxing the one-child policy and encouraging families to have more children, reversing demographic trends is a complex and long-term process. The effects of an aging population are already being felt, and it remains to be seen whether these policy changes will have a significant impact.

China’s economic rise has been a defining feature of the 21st century, but it is not without its challenges. President Xi Jinping’s policies have, in some cases, exacerbated these challenges rather than alleviating them. The ballooning debt levels, crackdown on the private sector, and demographic shifts all contribute to what some experts describe as a ticking economic time bomb.

Addressing these issues will require careful and strategic policymaking, as well as a willingness to embrace economic reforms that prioritize sustainability and innovation over short-term growth. Whether China can defuse its economic time bomb remains to be seen, but the stakes are high, not only for the country itself but also for the global economy, which has become increasingly interconnected with China’s fortunes.

Share this: